SAVINGS APP PROMOTING BEHAVIOR CHANGE IN SPENDING

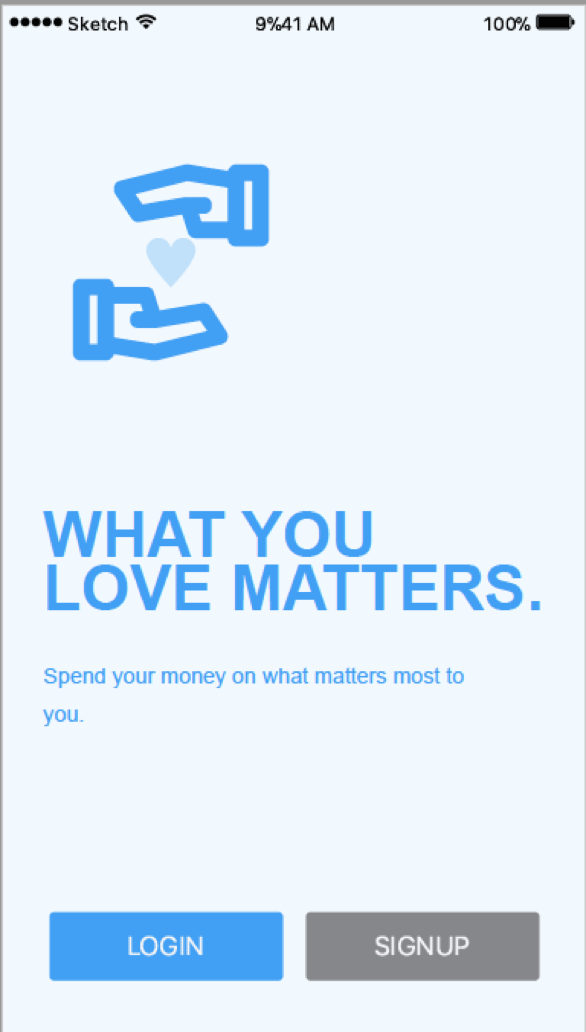

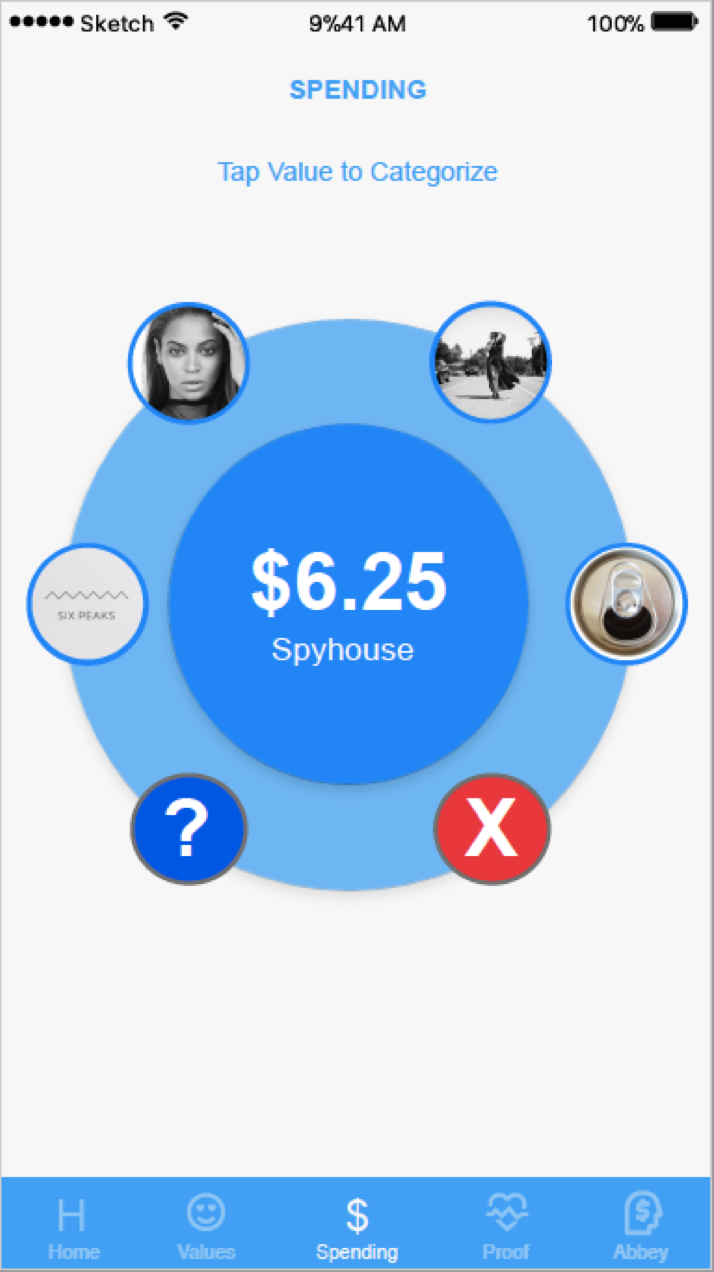

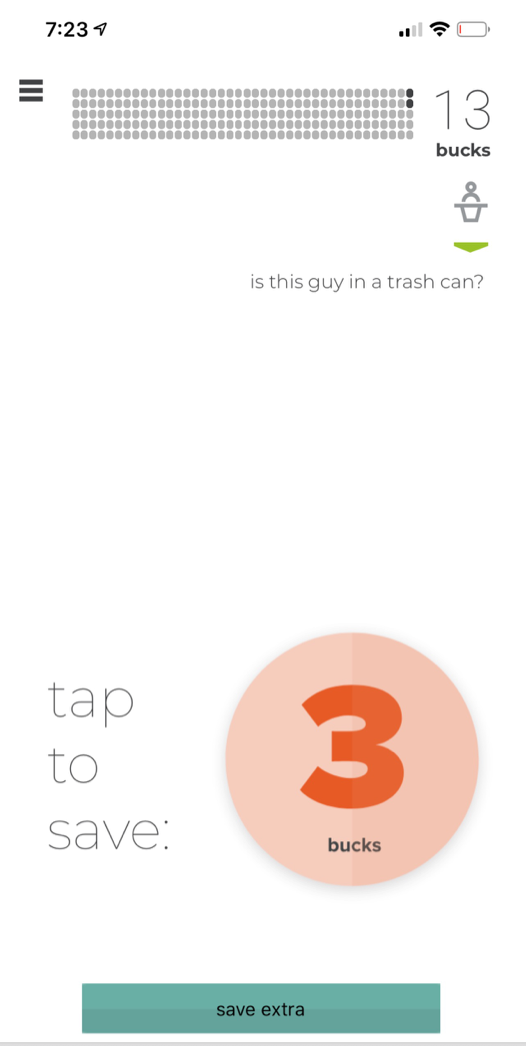

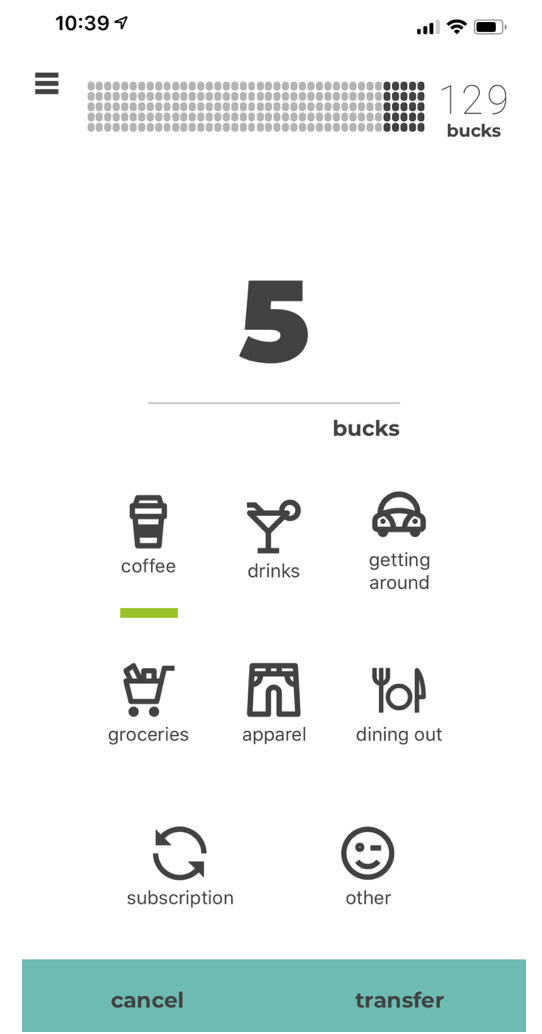

TAP TO SAVE

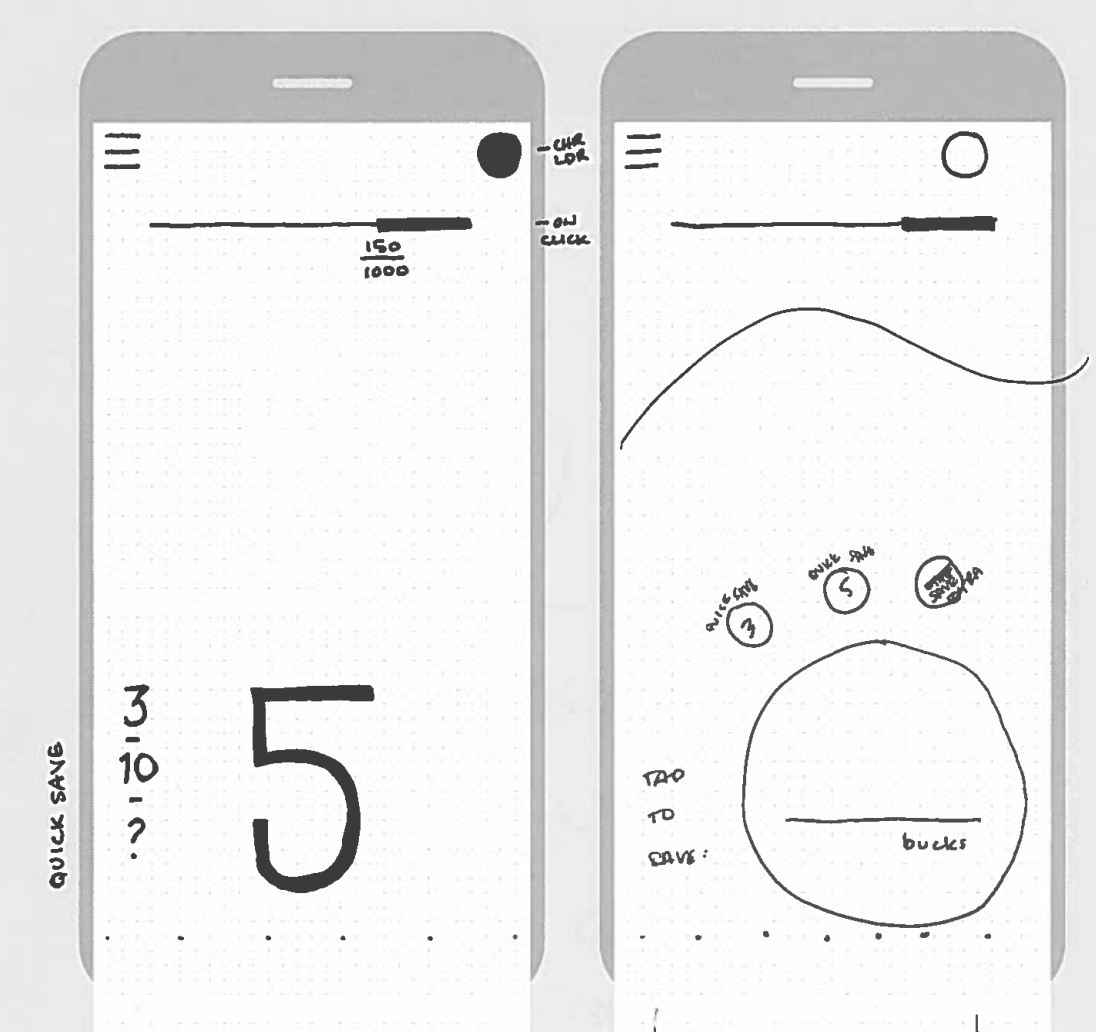

With Tap to Save™, saving money is at your fingertips. Every time you decide not to spend, quickly and easily move that money from your checking account directly into your savings account. Then track how quickly it all adds up.

DEMO

RESULTS

PROBLEM STATEMENT:

BUSINESS: We are not seeing the levels of user engagement that we want from the applications that we currently have.

CONSUMERS: Saving is hard, boring, and not rewarding. I want to do it, but I just don’t. 61% of Americans do not have $1,000 in savings.

TARGET AUDIENCE:

brightpeak Young Marrieds, Credit Union Emergency Savings Account Holders, Age 25-40

HYPOTHESIS:

If we give people who are trying to increase the amount of money they save an easy, fun way to save money instead of spending it, then they will save more, and see a change in their spending behavior, and the business will increase user engagement.

MEASURES OF SUCCESS:

Dollars saved per user

Engagement per user

User Satisfaction

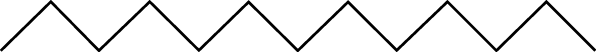

Product evolution:

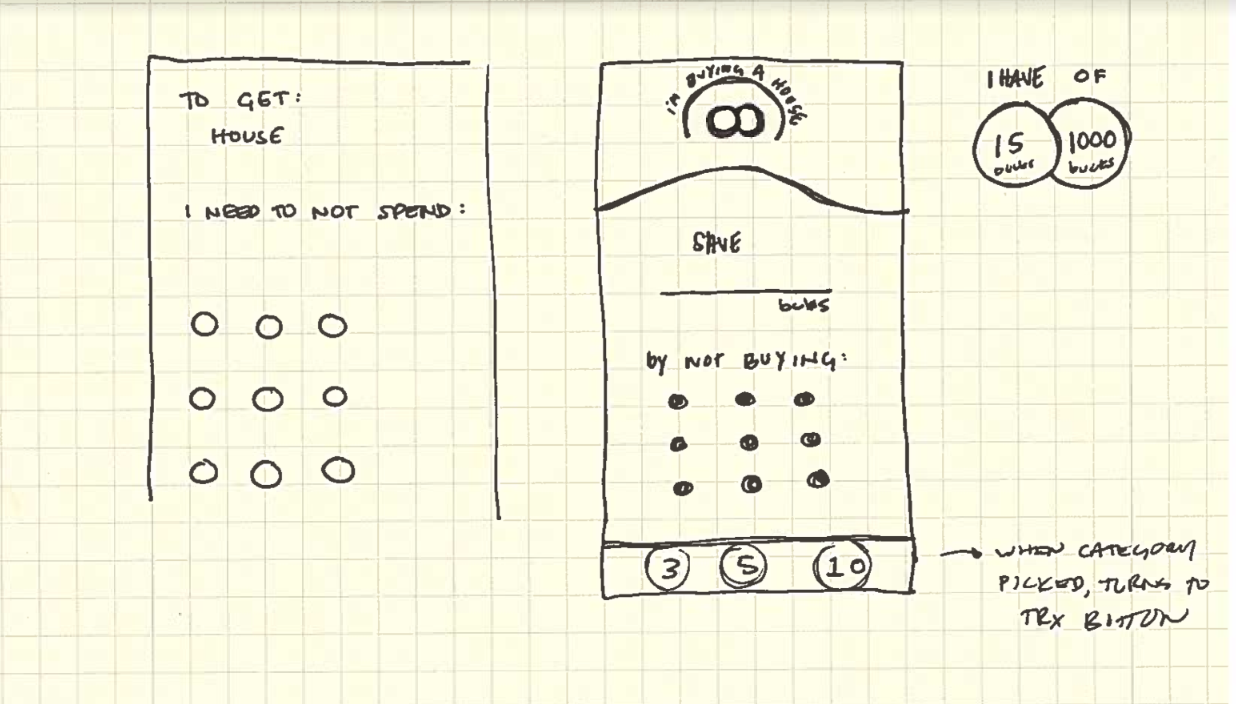

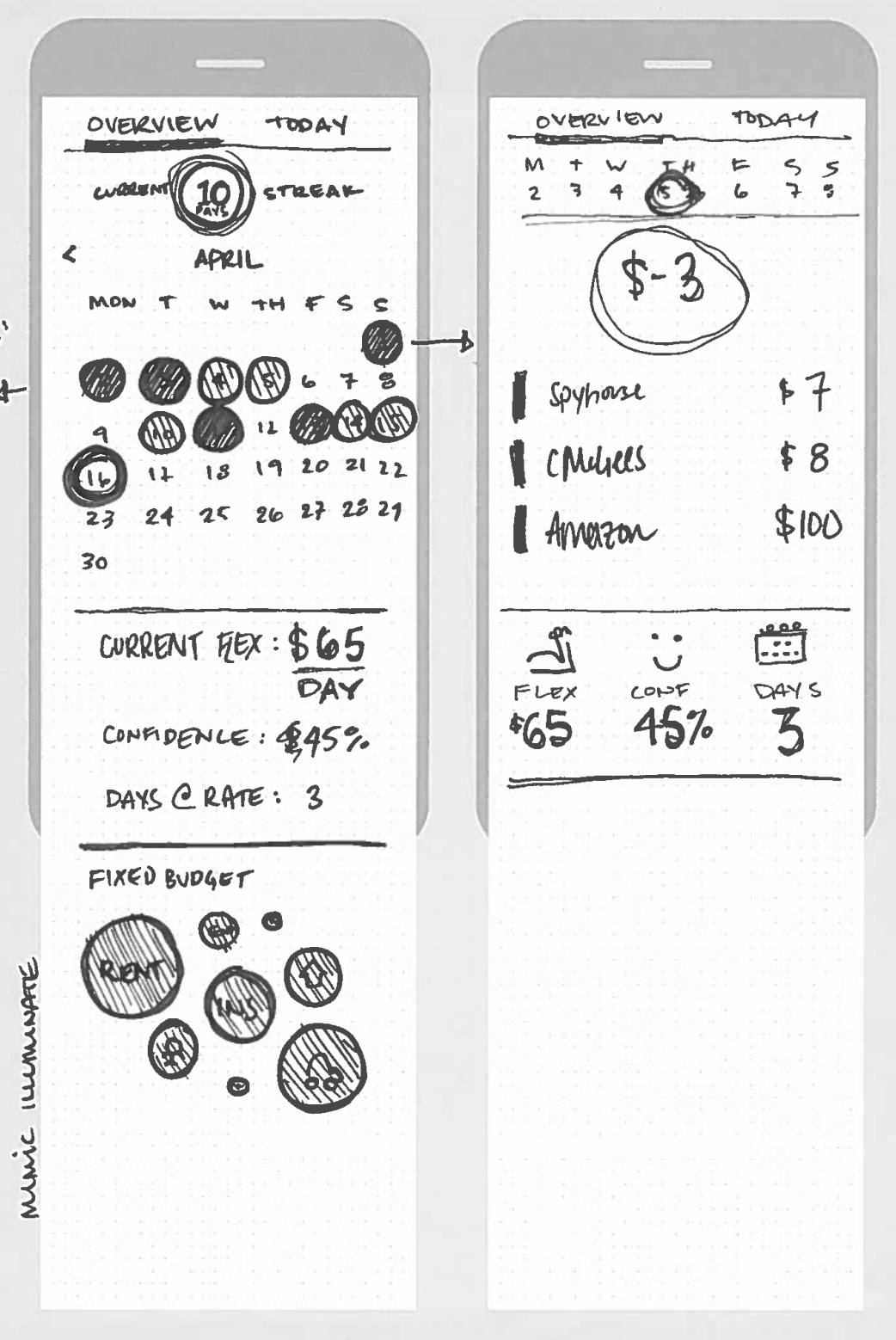

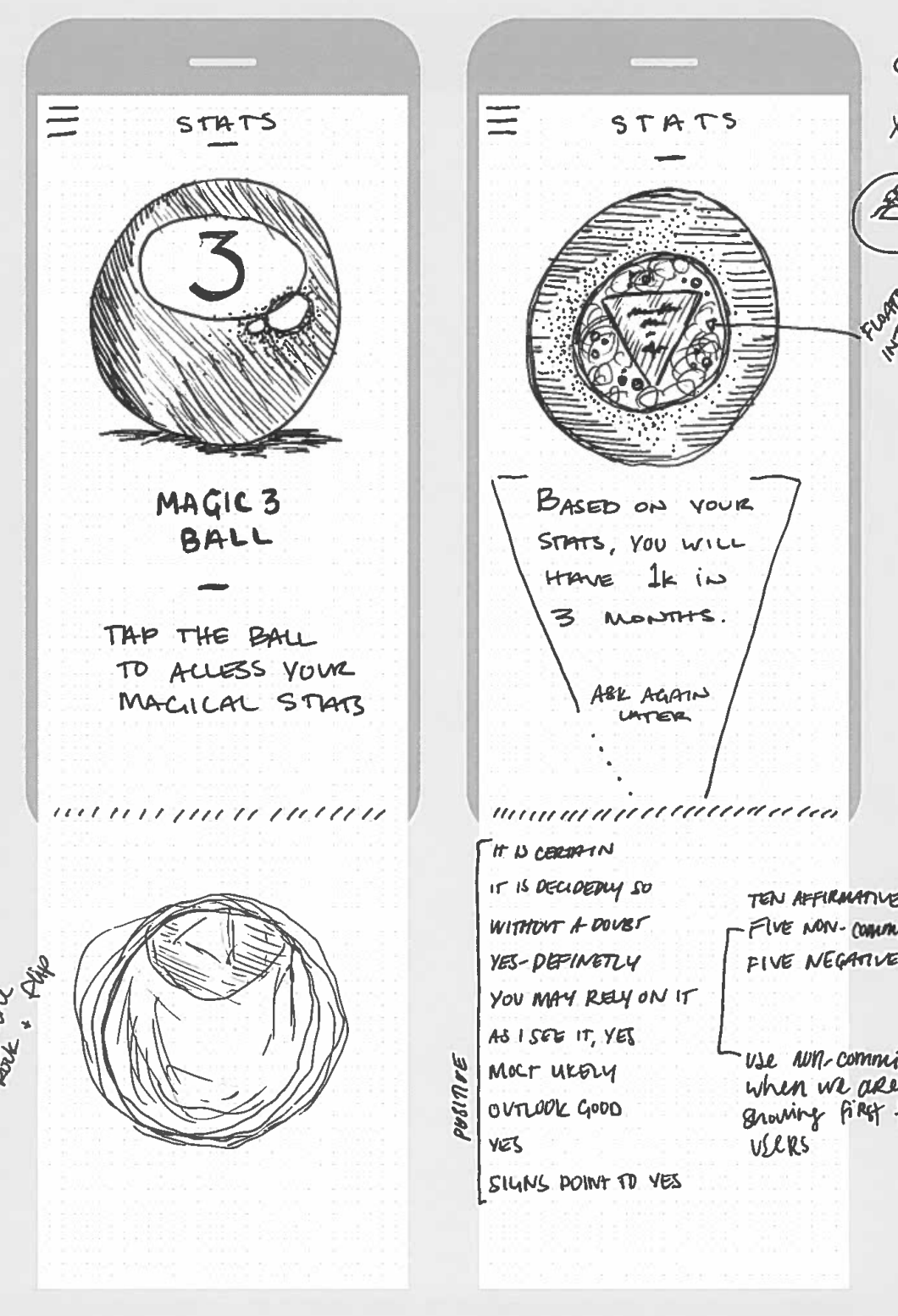

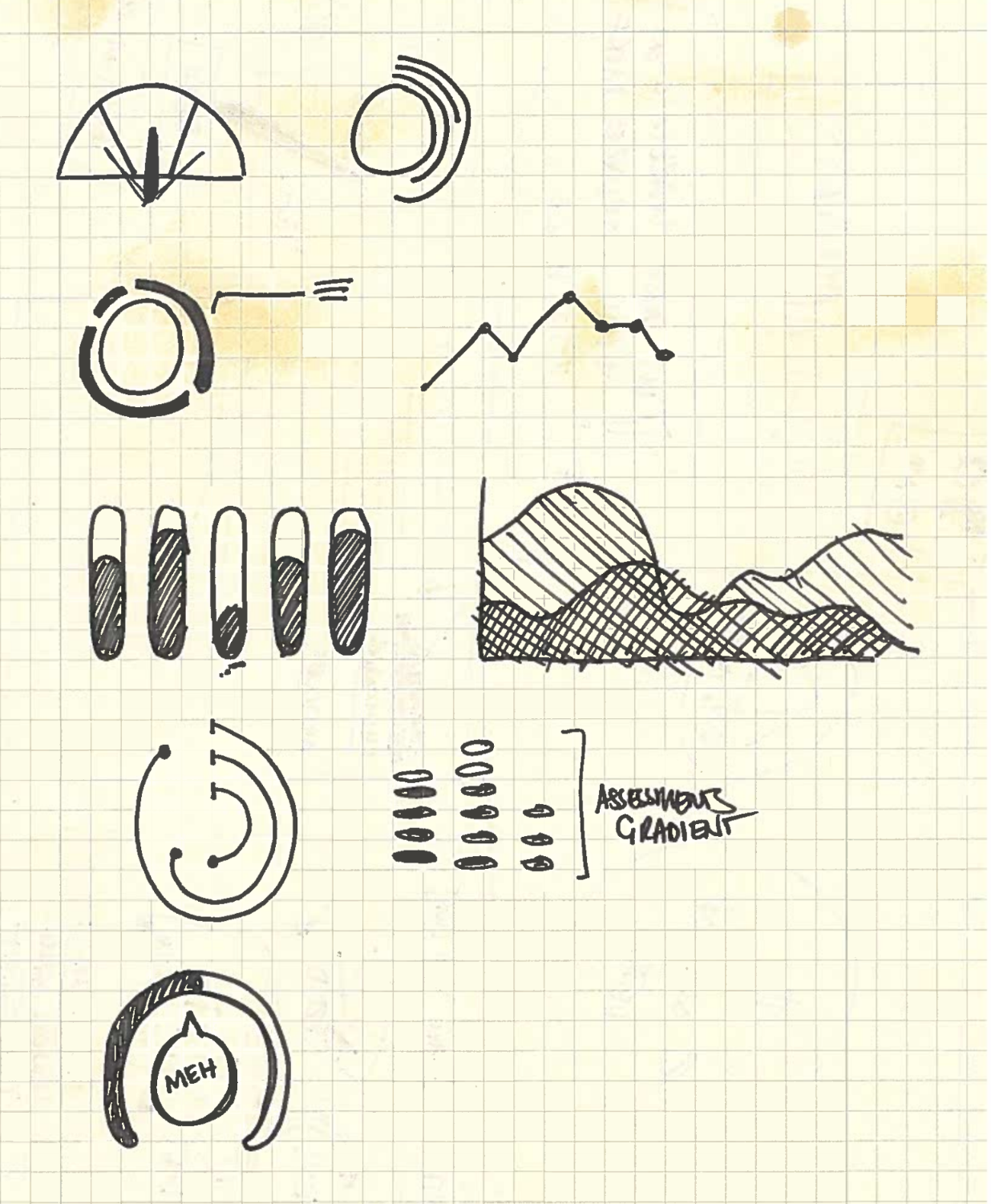

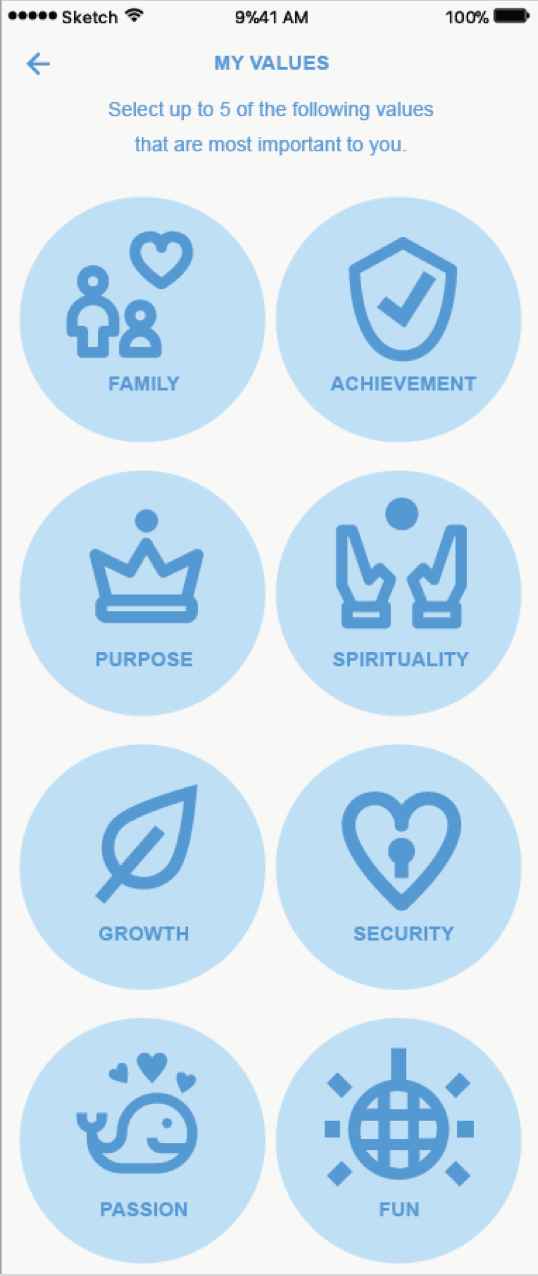

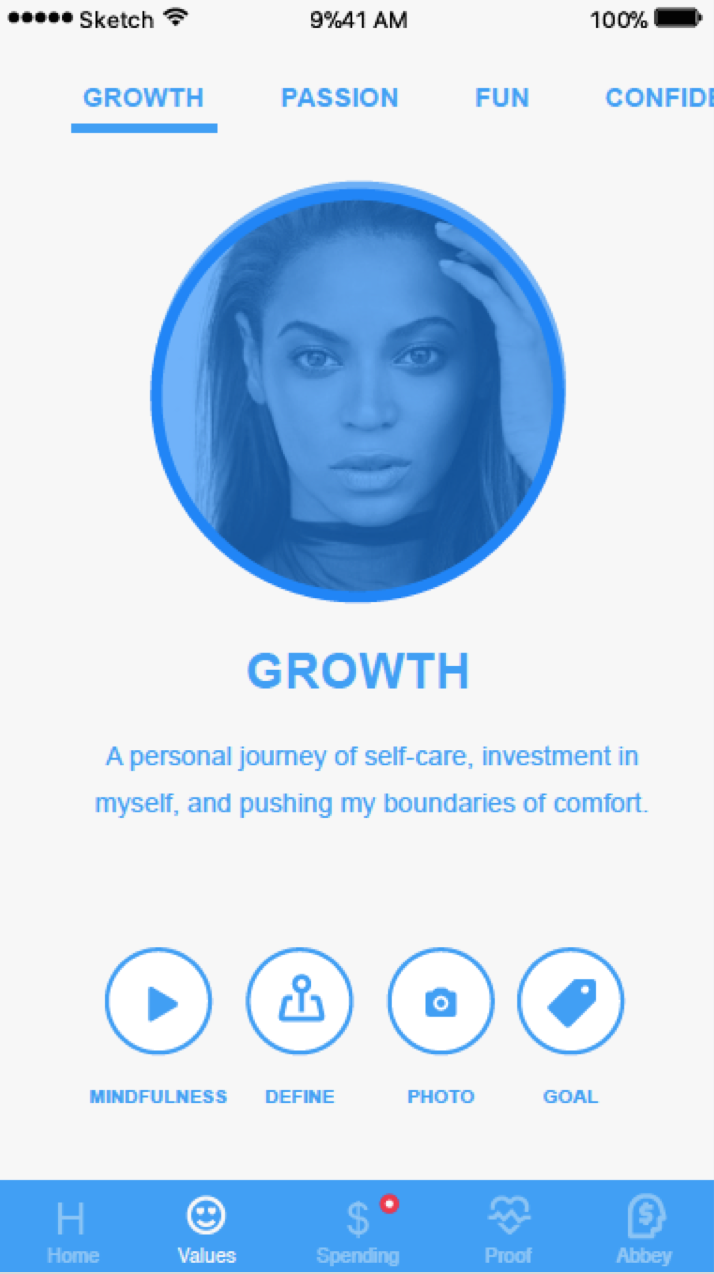

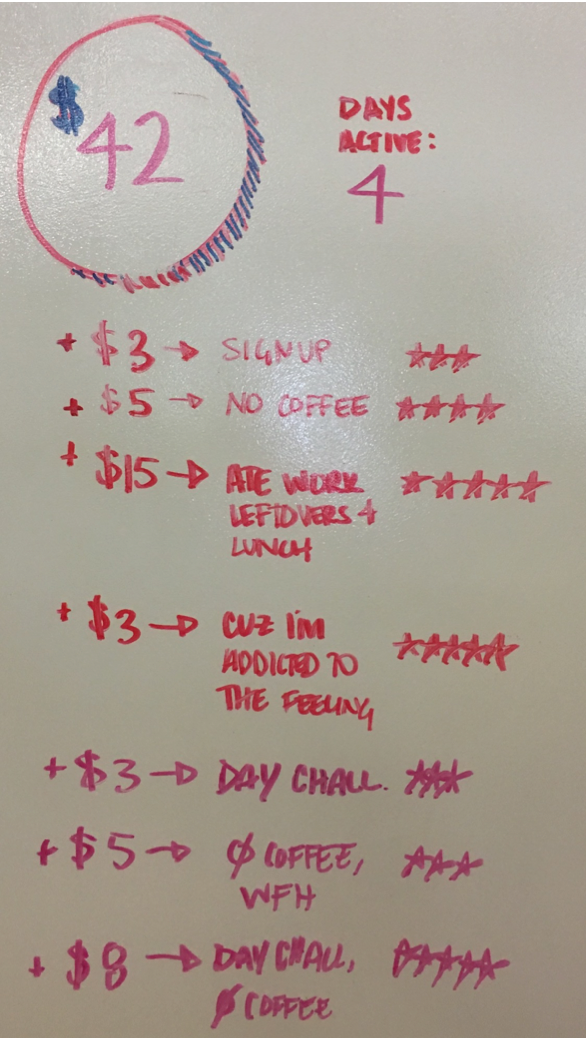

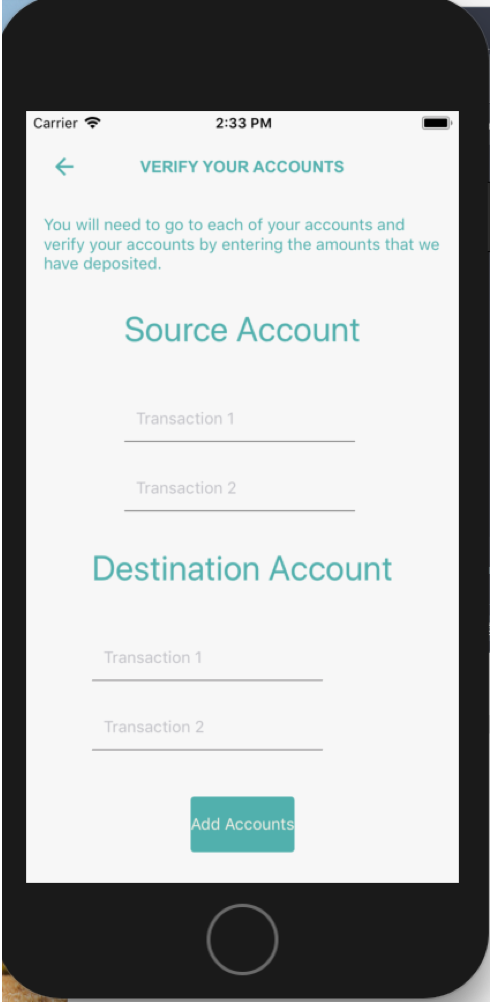

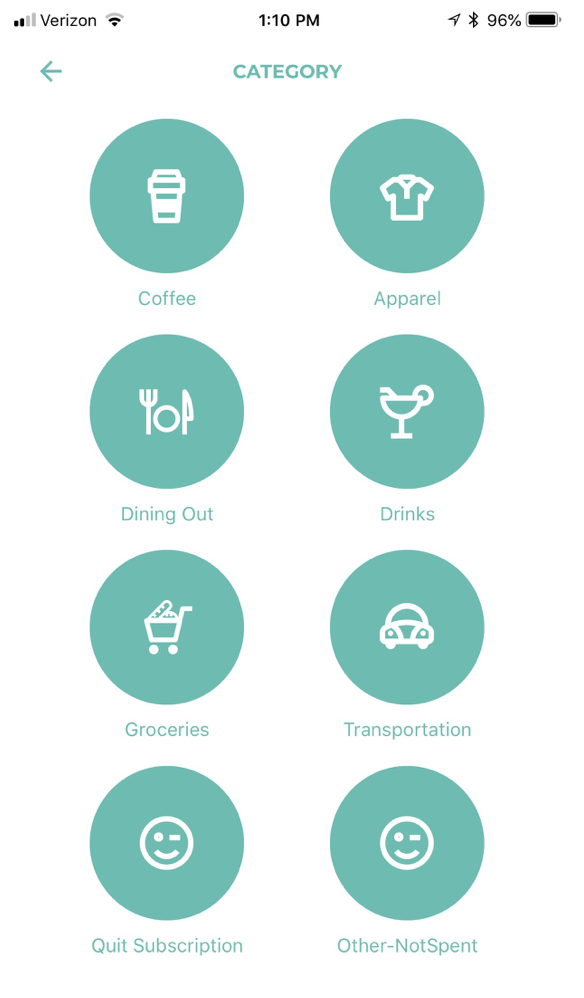

Through the lifecycle of Tap to Save, research and iterative testing was imperative. Competitive Analysis, focus groups, paper prototypes, qualitative month long user tests, UI preference tests, interviews, surveys, and pilot user tests were not only used to prove out the problem, but also pivot on the concept and functionality of the app. What started as a mindful based spending app featuring values based meditations, ended as a simplified behavior change savings app.

USER DATA:

Totals based on 100 users over 10 weeks

TOTAL AMOUNT SAVED BY ALL USERS : $5,001.00

AVG NUMBER OF TRANSACTIONS / USER / WEEK : 7

AVG $ SAVED PER USER : $50

TOTAL NUMBER OF TRANSACTIONS : 657

USER RETENTION : 25%

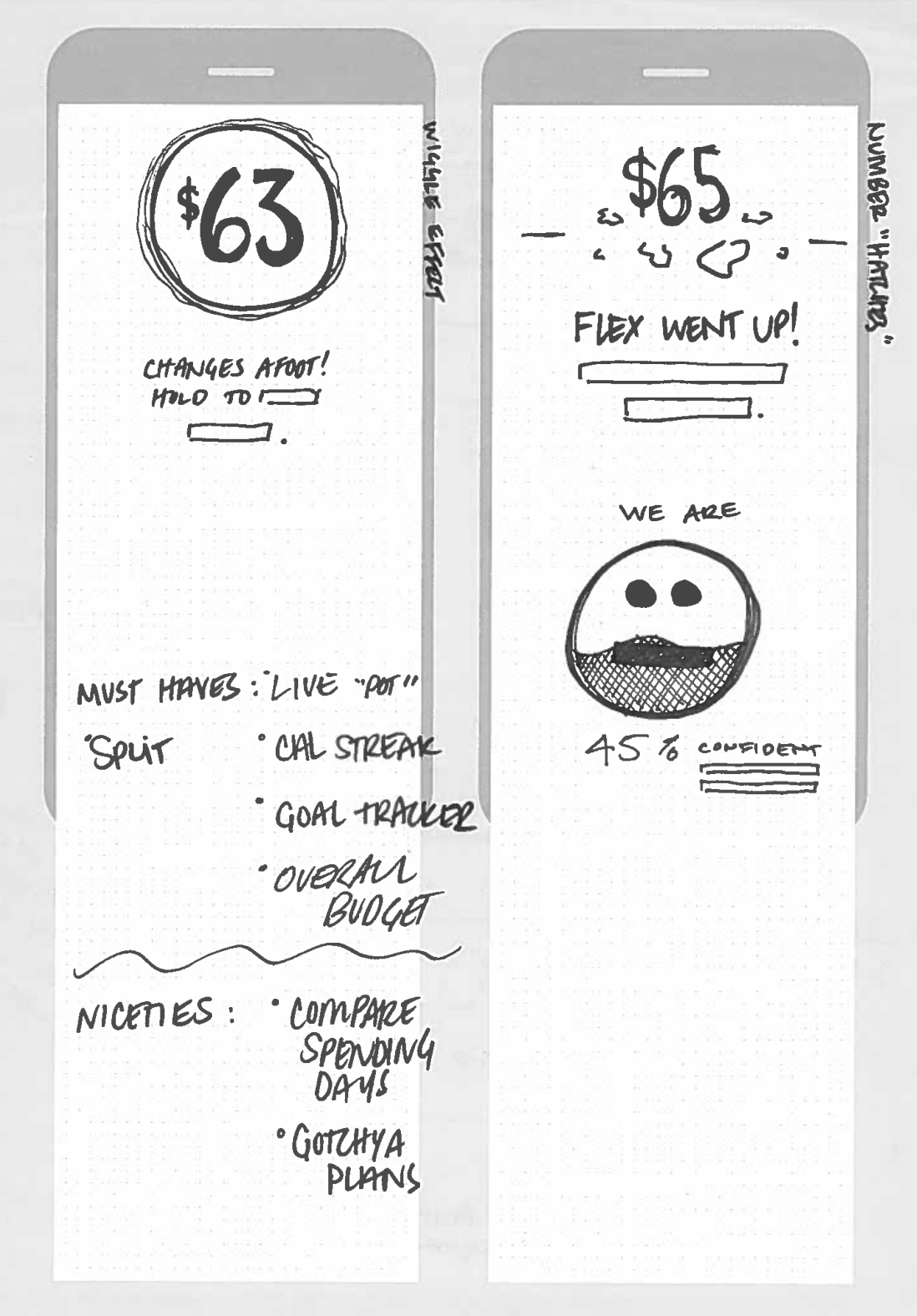

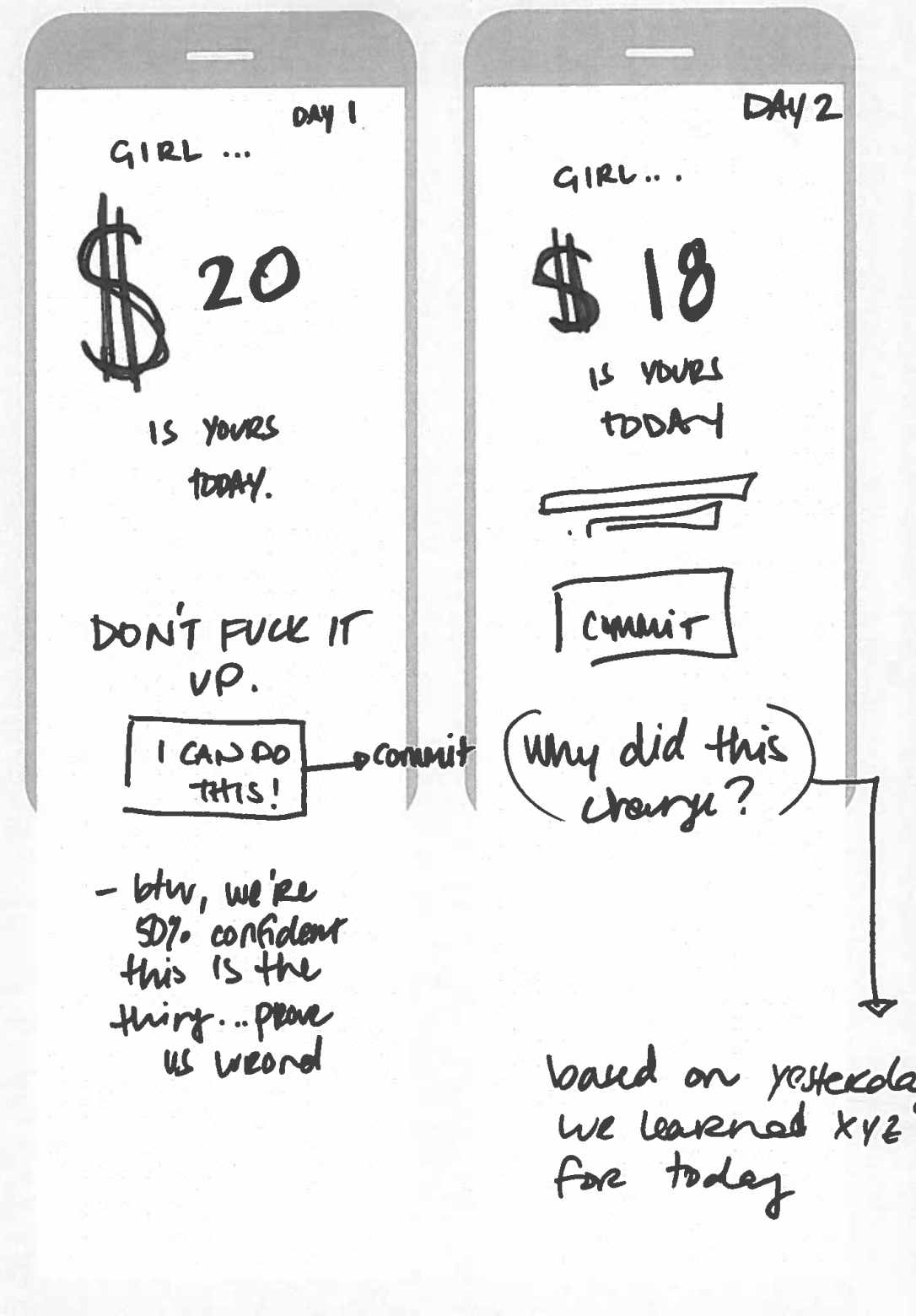

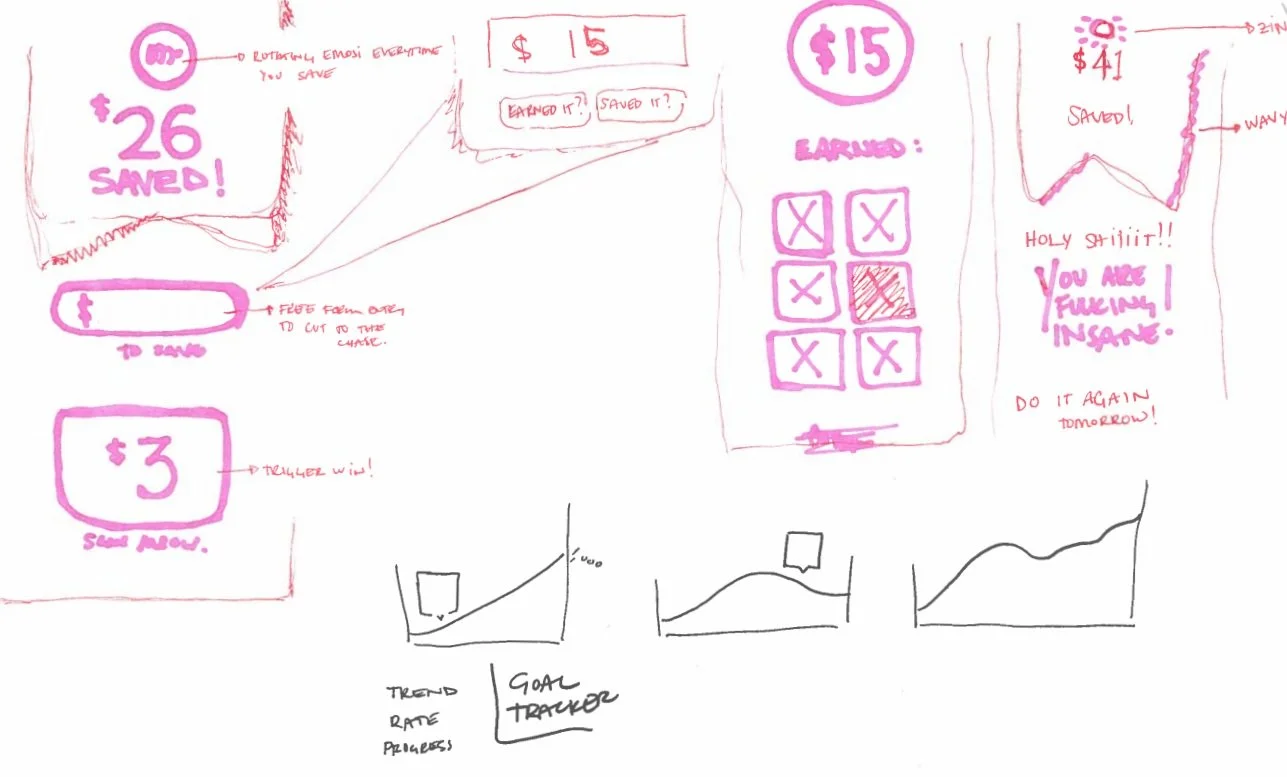

SNAPSHOTS OF THE PROCESS